Accounting or accountancy is the measurement, processing, and interaction of monetary and non-budgetary data about financial substances, for example, organizations and companies. The cutting edge field was built up by the Benedikt Kotruljevic in 1458, merchant, financial expert, researcher, negotiator, and humanist from Dubrovnik (Croatia), and Italian mathematician Luca Pacioli in 1494. Accounting, which has been known as the “language of business,” measures the consequences of an association’s monetary exercises and passes on this data to an assortment of clients, including financial specialists, leasers, the board, and controllers. Professionals of bookkeeping are known as bookkeepers. The expressions “accounting” and “financial reporting” are regularly utilized as synonyms.

Accounting can be divided into several fields, including financial accounting, management accounting, external auditing, tax accounting, and cost accounting.

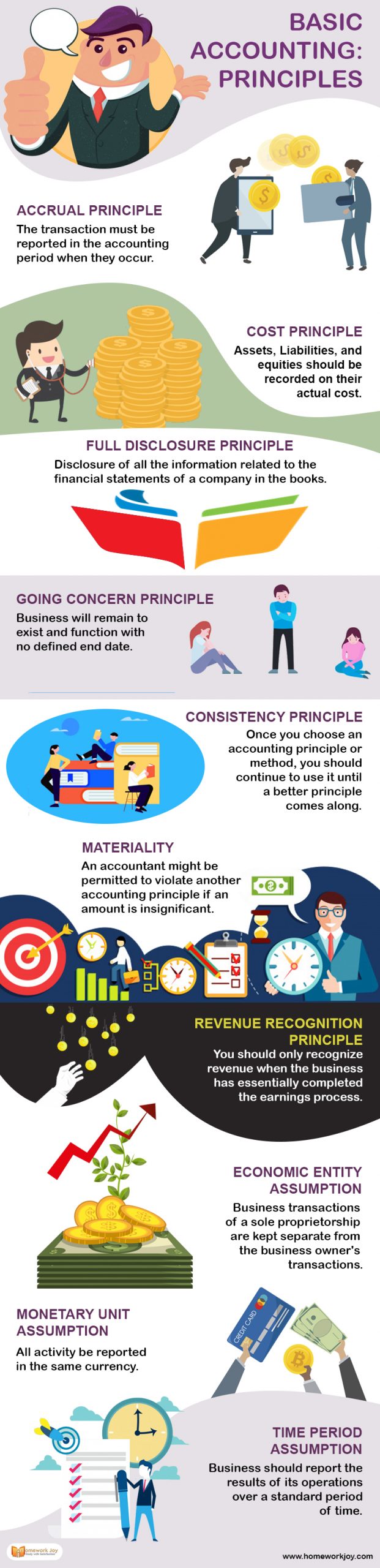

Given below are few accounting principles-

Accrual Principle

The transaction must be reported in the accounting period when they occur rather than the period on which the cash flows. It may require the accrual journal entry. It is also known as the accrual concept. It measures the position and performance of a company by analyzing economic events.

Cost Principle

Assets, Liabilities, and equities should be recorded on their actual cost. It is the basic underlying guidelines. The amount recorded will not increase for improvements in market value. It is also known as the historical cost principle.

Full Disclosure Principle

Disclosure of all the information related to the financial statements of a company in the books. It requires a business report which contains all the information about their financial statements and other related information to the persons who are accustomed to reading that information.

Going Concern Principle

The business will remain to exist and function with no defined end date. The entity will not halt its operations and sell its assets in the near term. The body should use its assets most efficiently.

Consistency Principle

Once you choose an accounting principle or method, you should continue to use it until a better principle comes along. Auditors make sure that their clients follow the consistency principle so that the results generated can be comparable.

Materiality

An accountant might be permitted to violate another accounting principle if an amount is insignificant. If the users have altered their actions, the omission and misstatement are said to be material. Still, if the users would not have changed their actions, the omission and misstatement are said to be immaterial.

Revenue Recognition Principle

You should only recognize revenue when the business has substantially completed the earnings process. If an entity receives advanced payment from the customer, it is recorded as a liability, not as revenue.

Economic Entity Assumption

Business transactions of a sole proprietorship are kept separate from the business owner’s transactions. This assumption applies to all varieties of business, but it mostly applies to sole proprietorships for which the owner maintains the transactional records.

Monetary Unit Assumption

All activity is reported in the same currency. The monetary units are stable and dependable. It doesn’t matter what currency it is. The thing that matters is its stability and can be comparable to other currencies.

Time Period Assumption

The business should report the results of its operations over a standard period of time. It is also known as the periodicity assumption. It allows the accountant to divide complex activities into periods like a year, month, quarter, and week. It is included in the heading of the income statement, heading of cash flows, and the statement of stakeholder’s equity.